If you want money, seeking credit could possibly be your better as well as perhaps only option. But choosing the right kind of a loan is crucial. The seemingly small contrast between various options can create a huge affect finances, so understanding the exact nature of each and every type of mortgage is crucial if you’re contemplating credit – a short-term one.

The thing is that you will find there’s wide range of available loans you might apply for, so it’s vital that you know which kind is best for you underneath the given circumstances. Having each of the info beforehand could help you save a lot of trouble later, therefore it makes perfect sense to invest some time researching different possibilities before you make your own preference.

Those people who are in urgent need for liquid funds usually don’t have time to pass through lengthy procedures necessary for receiving a long-term loan coming from a major bank, or they might have a low credit score that prevents them from getting qualification. Such individuals could be entitled to get immediate assistance by means of title loans or payday advances. Despite some overlapping features, both of these forms of loans have clear distinctions and borrowers should become aware of all details prior to signing their names on the dotted line.

Listed here is a quick overview that will help you decide whether a title loan or a payday advance is best for you:

WHAT ARE TITLE LOANS?

The defining sign of a title loan is it has to be backed by some type of collateral, specifically by the vehicle title. The maximum amount the borrowed funds is normally according to a amount of the estimated car value, but title loans can be obtained for amounts just $100. With regards to the amount along with the exact agreement with the institution making your loan, your debt may be settled at one time or even in multiple installments over a period of time.

To be eligible for this sort of tax assistance, it’s important to possess a clear legal ownership in the car, without any prior liabilities about the same car title. Credit score is very irrelevant in this instance because the transaction is backed by tangible assets. So almost every car, truck or RV owner can depend on this sort of credit in the event the situation necessitates it. The automobile title will probably be moved to the borrowed funds company in case there is a default, although some lenders desire to avoid this scenario whenever feasible and can frequently provide a delayed credit repairing repayment schedule where the debtor pays exactly the interest for any couple of months before the guy can pay off the outstanding amount.

WHAT ARE Payday advances?

As opposed, payday advances don’t require any type of property as collateral, since they are associated with borrower’s regular income and repaid as soon as the next paycheck is available in (and so the name). Often known as “salary loans” or “cash advance loans”, this funding method is widely used to acquire via a temporary cash shortage to make payments until you get the next paycheck. Pay day loans may be issued in a short time regardless of credit rating or existing obligations, which is the reason they are well-liked by those who would certainly struggle to secure long-term credit or are hesitant to wait for an bank loan process to be completed.

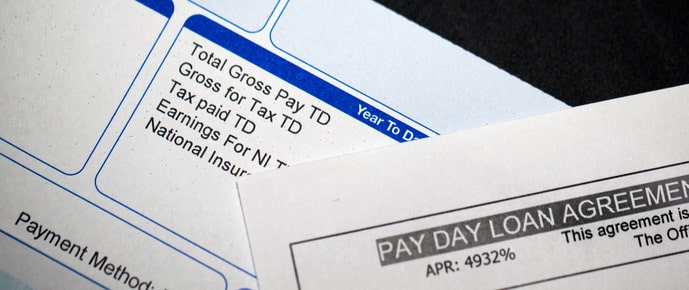

The borrower must prove his employment for the lender as a way to receive cash. Normally, this is created by showing the pay stub or bank statement demonstrating once a month income, along with the loan is normally approved right then in the event the necessary conditions are met. Anybody using loan must write a postdated look for the full volume of the borrowed funds plus interest calculated to the duration of planned debt to finalize the deal. The conventional interest charged on payday advances can be quite high, up to 400% APR.

Which are the SIMILARITIES Backward and forward TYPES OF LOANS?

Title loans and payday advances can both be called short-term, high-interest loans which might be suitable for small quantities of money which can be repaid quickly. A person’s eye minute rates are typically higher than with traditional business financing loans, therefore it doesn’t make much sense to rely on these sources of financing when you require to pay larger expenses that you would prefer trying to pay back over a long amount of time. Neither type is associated with borrower’s credit score, which is the reason the lender assumes a lot of risk which can be partially mitigated through higher interest rates for many customers.

Speedy approval procedure is yet another thing that both of these forms of loans be associated with common, making payday advances and title loans worthwhile considering whenever there’s some type of urgent crises that really must be addressed at once. Simplicity of the procedure is a big good reason that thousands of people utilize these a line of credit even if they are able to gain access to long-term financing should they wished to. Both forms of loans are considered to become valuable varieties of help for people who have lower and mid-range income levels, specially when unexpected expenses have to be handled quickly.

Which are the DIFFERENCES?

The most obvious contrast between title loans and payday advances is the first kind is secured by the material asset, even though the latter type is classed as unsecured. Used, because of this the borrowed funds company has significantly less uncertainty with title loans, to find out still some possibility to the car to become stolen or wrecked before the loan comes due. In the event of a quick payday loan, the total amount owed needs to be returned personally around the agreed date, although lender can cash the verify that your debt isn’t settled. Again, you’ll be able (though unlikely) how the lender lost his job in the intervening time, putting the lender at risk.

Another key difference may be the entire payment term. Pay day loans are rarely issued for periods longer than a fortnight and are likely to get paid fully in those days, which is the reason they could never exceed the total amount stated around the previous paycheck. On the other hand, title loans can sometimes last for many weeks or perhaps months, and refinancing is possible in some cases. That means car title loans are generally somewhat larger and could be useful for larger cash needs.

What sort of LOAN Is best?

This is a question that can’t be answered definitively – each kind of loan has its own pros and cons. Despite their considerable similarities, payday advances and title loans are meant for different situations and lenders have to be aware of exact conditions as a way to adequately estimate what one they will really need. It would be a mistake to equate both of these categories and to ignore the small but relevant distinctions that may have serious consequences in the event the loan comes due.

Speculate a guide, payday advances are generally a good choice if you urgently might need some spending cash, your next paycheck is still a few days away and you’re happy to pay off the entire loan (with interest) together with your next paycheck. However, in the event the amount needed is higher than your weekly income or you can’t realistically pay off your debts together with your next paycheck, title loans end up being the more appealing option. Naturally, individual circumstances are vastly different along with the sound decision is dependent upon many factors – as an example, those who don’t own a vehicle obviously would not be eligible for a title loan.

GENERAL LOAN ADVICE

Every loan can get lost folks who wants take certain precautions, and title loans and payday advances are not any exceptions. It is extremely very easy to forget how the readily available cash is not actually yours so you are borrowing to your future income. Because of this, it is strongly suggested that loans are taken only once crucial no other solution is found, as well as then your amount shouldn’t be in excess of is enough to solve an issue. Doing a criminal history check in the lender for example reading their online reviews and in addition inquiring about any extra fees can also be important steps that can reveal some hidden risks with certain lenders. These simple steps will not be skipped, even during essentially the most desperate times.

For more details about title loans browse this useful web site: click here